The latest report from KPMG heralds good news for online retailers for the festive period, revealing that over the three months prior to January, online sales grew by 8.6%. This good performance was also reflected in the data from Brightpearl. Over the 45 day period (from 17 November to 31 December 2017), the total number of orders placed via online retail channels increased by 8.7% in the UK. Meanwhile, growth in the US was back in double-digits, at 14.5% during the same timeframe.

The data also supports the findings of a 2017 Deloitte survey that polled shoppers about their anticipated holiday spending, published in October. The survey found that “55 percent of respondents plan to shop online for gifts, increasing online shopping’s lead over mass merchants, where 44 percent of those polled plan to shop.” This is a shift from 2016, when the same survey found that online and in-store purchases comprised an equal share, at 47 percent each.

However, this change in attitude also presents new challenges…

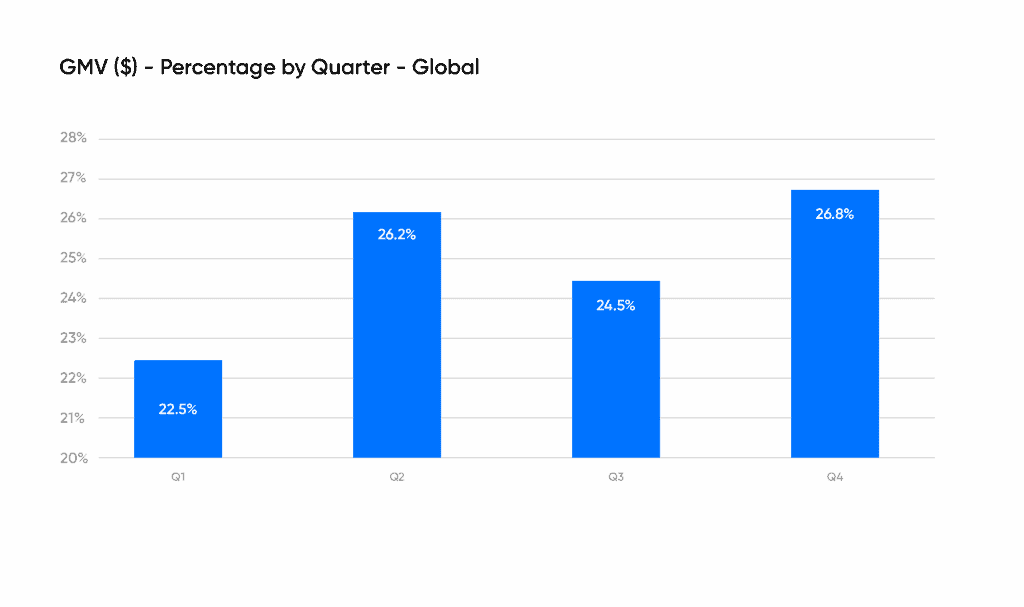

End of year sales

The trend means that the closing months of the year are now more important than ever. In terms of total spending for 2017 (gross merchandise value), the fourth quarter accounted for 26.8% of total sales. Q1, meanwhile, was the quietest, with total spend for the quarter representing 22.5% of the total spend in 2017.

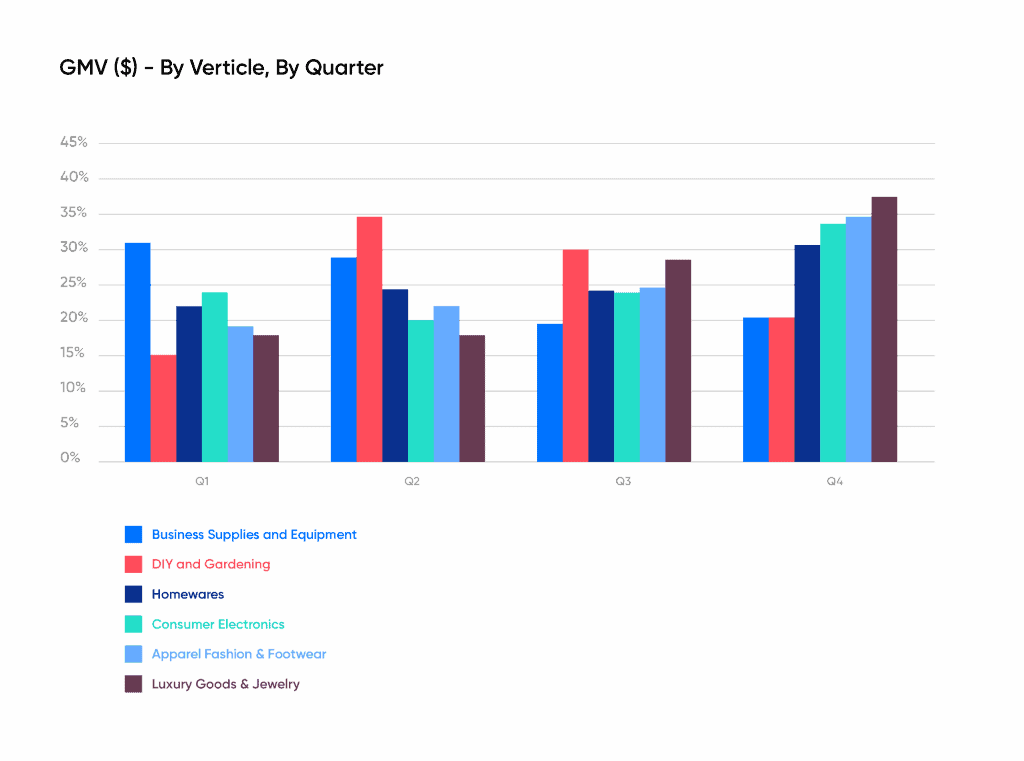

The importance of end of year sales varies significantly when the data is split by different verticals. For Homewares, Consumer Electronics, Apparel Fashion and Footwear, and Luxury Goods and Jewelry, Q4 represents more than 30% of total annual sales and, with the exception of Homewares, the quarter accounted for more than one-third of total activity in 2017.

Conversely, Business Supplies and Equipment enjoyed its biggest quarter in Q1 at 31.5% of total annual sales. Also bucking the average trend is the DIY and Gardening sector, with more than one-third of sales occurring in the late spring and early summer months of Q2. This quarter accounts for 34.6% of total annual spend, followed by 29.8% in the summer months of Q3, dropping to 20.7% in the fourth quarter.

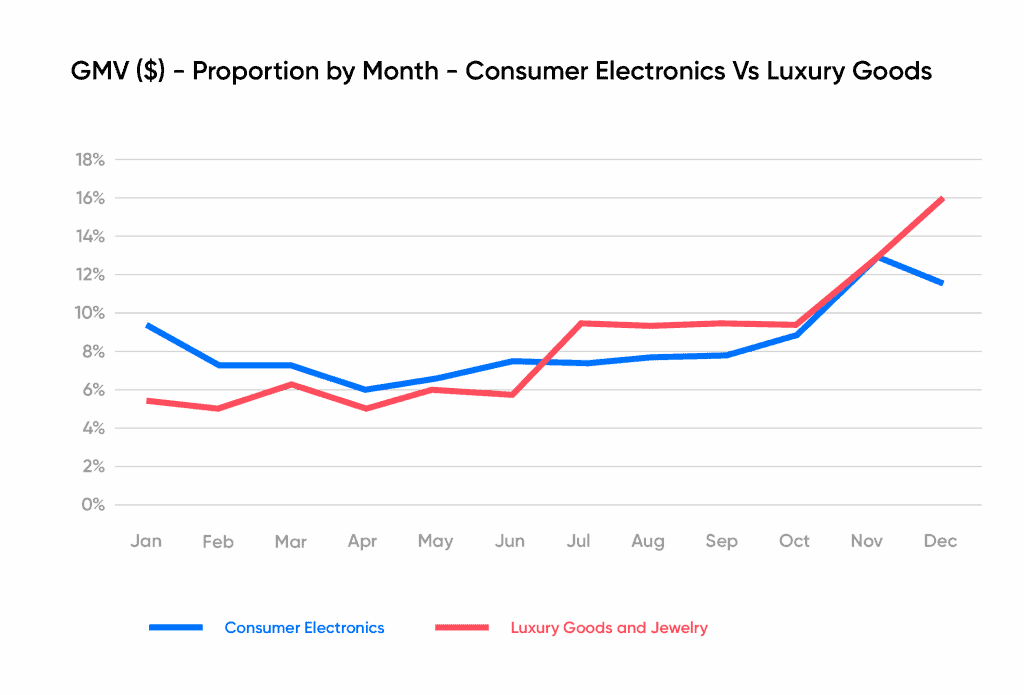

When we look at the impact of the holiday period, in particular late November and December, it is the Luxury Goods and Jewelry sector and the Consumer Electronics verticals that experience the most pressure from end-of-year seasonality, which is revealed in this month-by-month breakdown:

November and December accounts for almost one-quarter of spend for Consumer Electronics, rising to almost 30% for Luxury Goods and Jewelry. These verticals are demonstrating their appeal as the top targets for those all-important Christmas gift lists.

The impact of Black Friday & Cyber Monday

For online sales – Black Friday and Cyber Monday in the US and particularly Black Friday in the UK – have been growing in momentum, which has an impact on shopping activity throughout the December period. To measure the impact, we evaluated the daily performance of the total number of online orders, compared to the 45-day average for the period.

We found there is a growing success for Black Friday sales in the UK market, as it represents a 230% better performance than the 45-day average – up from 209% in 2016. However, we’ve also seen that on quieter days, the average daily performance drops lower than in 2016.

With more dramatic peaks and troughs, retailers must gear up more and more for being able to handle a steeper number of orders in a shorter timeframe, followed by quieter periods. This means the need for higher levels of efficiency, through deploying automation, will continue to shape the retailing landscape throughout the rest of 2018.

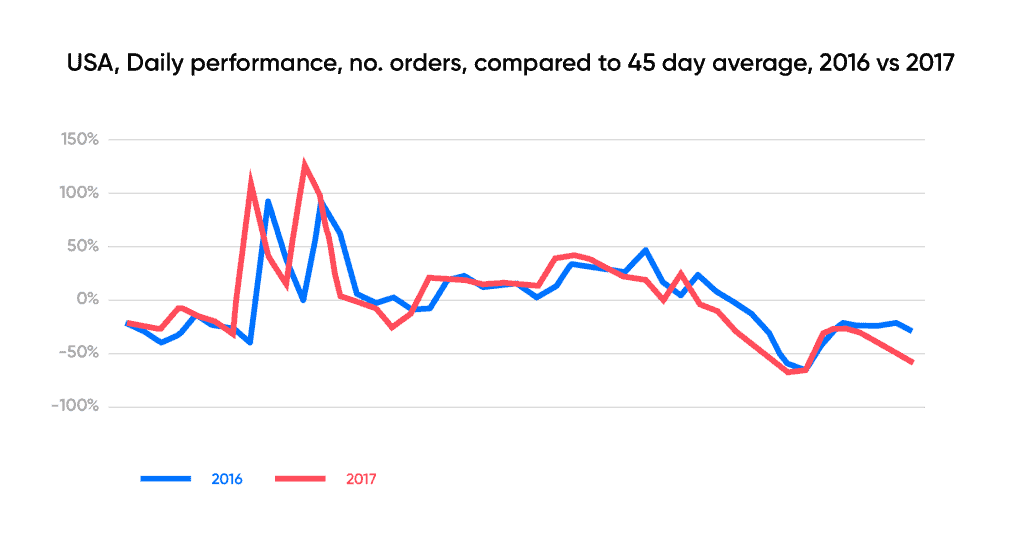

The US shows the same trend emerging:

In this chart, we can see the impact of Cyber Monday as well as Black Friday, followed by more unpredictable peaks and troughs, once again underlying the need for more efficient ways to cope with this type of buying behavior.

Performance over Christmas week

In terms of the proportion of orders placed over the Christmas week, from Christmas Eve to New Year’s Eve, once again December 28 proved to be the busiest day during this period in the UK.

However, unlike the previous year, December 27 claimed the second spot, followed by December 29 – nudging Boxing Day from second to fourth.

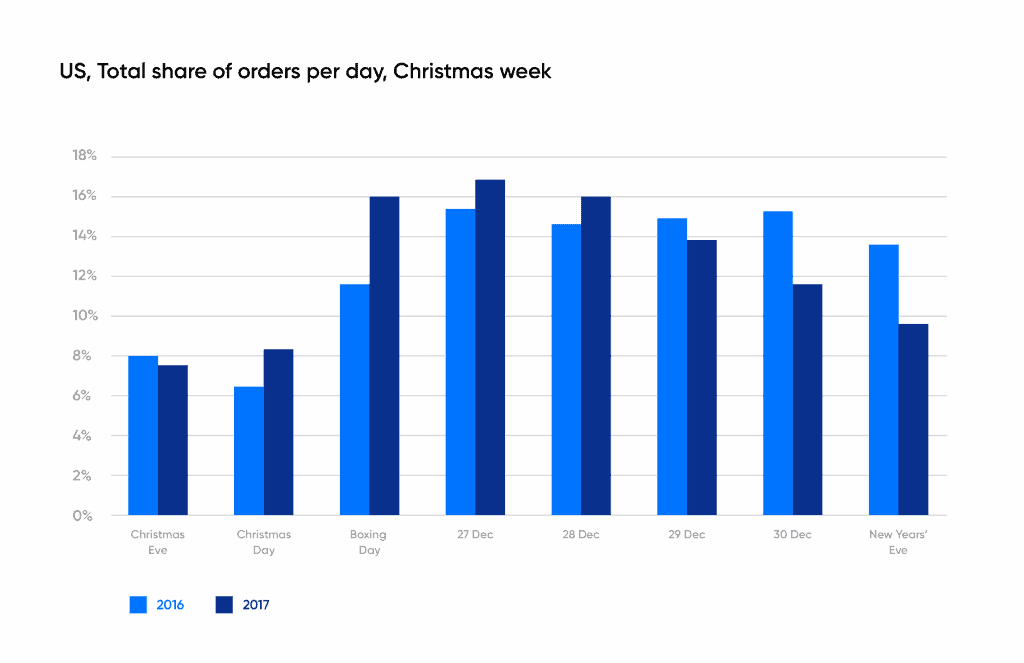

In the United States, it was December 26 that took second position, while December 27 was the busiest day of the period in a repeat of the trend seen in 2016:

Using automation to cope with seasonality

Regardless of sector or time of year, retailers will face more and more challenges in terms of anticipating the levels of spikes of demand and subsequent quieter phases of activity.

As Deloitte explains: “Many retailers have embraced agile working in specific areas of their business – the challenge is how can retailers now scale this across their business. All retailers have to respond faster and faster to rapid changing customer demand.”

One easy way to do this is by using an efficient back office system, like Brightpearl, which has built-in functionality to automate all your fulfillment, shipping and invoicing.

Ultimately, this enables you to manage orders by exception only, freeing up vital time and shifting the focus from repetitive back office processes to those all important growth activities.

But to conclude, Lee Adams, Managing Director of Open 24 Seven (one of our many globally successful customers), summarised the era of automation very succinctly in a recent video: “Automation is crucial if we’re going to remain competitive.”

How well does your business cope with peaks? Find out now in this quick 5 question assessment!