In today’s ecommerce environment, all-sized retailers are facing significant challenges: acquiring and integrating data into their smart analysis. Data analysis is the key to optimal retail decisions. Therefore, all retailers can’t avoid nor delay their investment in leveraging data for retail pricing strategies.

Your business data includes any information that comes from your target marketplace, customers, competitors, marketing projects, store conversions, and more. It gives you the ability to make a comparative analysis. By relying on your data, you can decide on new strategies to improve your profitability and competitiveness.

Since data has irreplaceable importance, it would be a big mistake not to use that information. However, one question remains, how to use your ecommerce data to fine-tune your pricing strategy and maintain your profits?

Making correct pricing decisions is difficult enough in tough times, especially for ecommerce. Up to 60% of online shoppers consider ecommerce pricing as the first criterion that affects their purchasing decision so it’s important to get it right.

You have seconds to win or lose a customer with your pricing strategies. In this article, we will focus on how to make your pricing strategies more profitable with accurate data.

Why should online businesses leverage data?

Analyzing data is the backbone of any successful ecommerce business. No matter the size of your business, all retailers can benefit from using proper and meaningful data.

Big data (complex and large data sets) is required to calculate valuable metrics for every retailer. These metrics will determine where a company puts its capital and investment.

However, data doesn’t act only as an analytical tool. It is also helpful for making improvements or changes to your business.

Utilizing solid data enables your company to succeed when:

- Finding and attracting new customers

- Assessing the value of current customers

- Increasing customer retention

- Increasing conversion rates

- Optimizing marketing spend

- Predicting sales trends

- Optimizing product offerings

- Optimizing online store design for better conversions

- Optimizing your pricing strategies

Whether your business is big or small, leveraging your store’s data into smart policies should be a must to improve your growth stage.

For example, you can use your data to segment customers into rules-based audiences to keep your pricing strategies dynamic. If you have a good data analysis system in place, it will be easier to leverage your data into dynamic pricing strategies. With developing technology and skills, it is possible to offer different product prices to customers from different segments.

With this method, you can make more profitable sales at an ideal price. Your data will show you which types of customers are visiting, at what hours, and in which position you are superior to your competitors. What you need to do is follow the path that your data addresses. You can build campaigns that are more likely to generate revenue if you have segmented your consumer-based data on well-defined rule sets.

Let’s take a more detailed look at how you can use your data to optimize your pricing.

How to conduct a price analysis

Conducting price analysis is necessary and beneficial, but somewhat painful. Due to not using the right analysis methods, categorizing the data incorrectly, and facing accumulated and complex data instead of checking it at short intervals; your pricing analysis can be challenging.

To make a pricing analysis, you must first know your products and competitors well. Analyze your competitors, and who else sells the same product that you sell and offer substitute products. Who are your closest competitors? What are the expectations of the customers looking for these products and what is the price they have in mind?

You need to fully understand your position in the market. Do you want to be more expensive than your competitors, or is it better to be cheaper to increase sales? You need to know where your prices stand against your competitors.

Run tests to discover if your analytics are working. Don’t stay still if you are not satisfied with the results.

What is a price point and why is it important to get it right?

The first step to making an on-point pricing analysis is getting your price points right. This is one of the key elements of managing a successful retail operation and relates to the product’s suggested retail price. Although the idea can appear simple at first, it can be rather challenging.

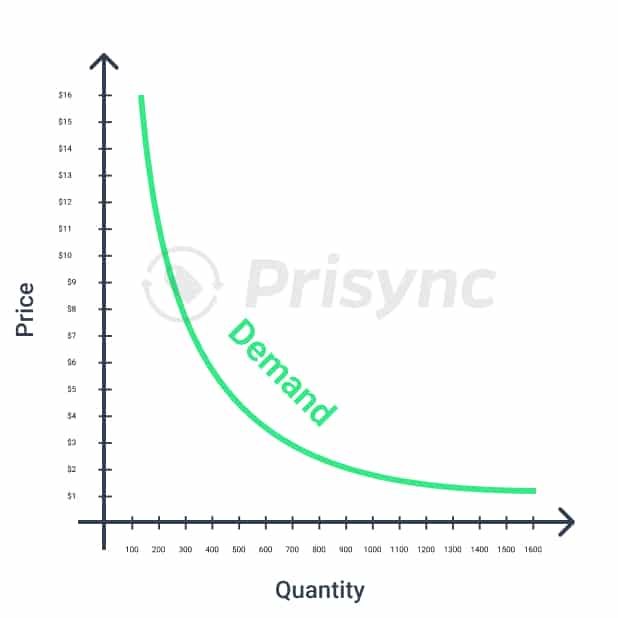

Price point describes a particular point on a scale of potential prices. Some of these potential points produce bigger revenues than others. We could ask each of the 1000 people in our marketplace how much they would be willing to pay for a specific product. It is, however, impossible to predict what each consumer would pay for a given good in today’s economy.

Retailers test various price points on the price point curve to determine the results. Since it could not yield the maximum profit, sellers don’t always decide to be the cheapest on the market. As a seller, you can test price points to obtain the optimal price/demand ratio for your products and see if it fits perfectly with your business strategies.

Source: Prisync.com

The only thing you need to remember is that a price point refers to a potential, speculative price. For instance, you could forecast that you’ll be able to sell 1000 t-shirts for $5. The cost is the actual price at which anything is sold or purchased.

You need to think carefully about setting the price for your products. Everyone will visit your store if you sell a product for a price that is exceptionally low. But, if your prices are too low you could end up losing money. You need to cover your expenses.

Using data analytics to set optimum price points

Data analytics can be utilized to attain ideal price points. The aim is to offer insights to understand consumer behavior that enables improved marketing and sales strategies. Modern retail analytics can compare different data sets. Such as the market prices of all the products you sell. Enabling you to strategically offer discounts, promotions, and other pricing strategies.

For example, you should understand the status of the average prices in the market, and follow the continuous developments. Evaluate the information provided by reports and data before setting up a strategy.

If your data tells you that your store is getting less traffic this month or if a product has become less preferable than your competitors, look for solutions. Change your pricing strategy. Or, if you discover that your shoppers compare prices since there is a lot of competition, you have to compete on price.

Here are some more specific methods for using data to optimize price points:

- Try to use a data analytics tool that will help segment your data. If you need to deal with a large amount of data, using tools will make your job easier.

- Use automation to analyze your data so you can save both time and effort.

- Categorize your data before reviewing it. It will make the job easier to divide the data into certain groups.

- Separate the data you will use for pricing strategies. Do it according to certain date ranges, busy working hours of the day, such as users’ information (e.g. age, occupation information), etc.

- It would be useful to test various pricing strategies periodically. After considering your results, focus on some of the more profitable pricing strategies (that fit your business style).

- Identify your best customers and competitors and do a retail analysis. Try researching to find out what kinds of data you should use for what purposes. This way you can leverage valuable insights from recent data.

Optimize pricing-related costs using data

Data is essential for streamlining all aspects of retail stores. Including inventory control, sales, back-office operations, and managerial tasks. Retailers should identify missing points and competitive edges for improvement. Moreover, they can reduce the expenses associated with these operations by examining pricing data from their marketplace. This can help the company offer more competitive pricing.

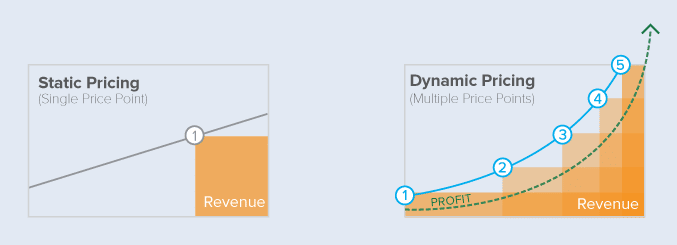

Decide on your pricing strategies by considering your costs. You can increase your profit by choosing a better pricing strategy such as dynamic pricing to stay competitive. Comparing product prices with competitors helps a lot to decide on dynamic prices. Keeping the prices cheaper, average, or more expensive than your closest competitors should be parallel to your business and pricing strategy.

In addition, aim to expand your target audience in your best-seller products. These are visible in your pricing data and provide you with the highest revenue with various methods such as bundle pricing. You can bundle your least favorite products with average ones, or choose to promote best-performing products to have competitive pricing. It’s all up to you.

There will be several circumstances when you discover you have the chance to raise your prices. Some retailers want to increase prices without alienating customers which is a very difficult situation. In these cases, it is important to have control of your pricing in the best ways.

For example, thousands of individuals participate in marathons every year. Imagine being able to change your pricing based on how soon the following major marathon was coming up. It is also applicable for the holiday season. As Black Friday and Cyber Monday require very competitive pricing, staying dynamic and tracking competitors’ prices can help you in maximizing profits.

Source: mypermissions.com

Additionally, retailers can determine price points according to their data. But that doesn’t mean you just need to have a fixed price point. This price point can change over time as you can see in the table above. So, having dynamic and increasing price points can lead your business to increase its revenue in the long term.

Calculate the Price Index

Your pricing positioning in the market is shown by the Price Index indicator (PI). The price index is a measure used by ecommerce companies to show how their brands, product categories, or products are positioned in the market.

Business owners are empowered by this knowledge in so many ways. Let’s say that across all goods, a competitor’s PI for a single brand is significantly lower than yours. The most logical explanation is that the competition obtained a better deal from the other seller. You may ask the provider for the same price now that you’ve calculated it.

In addition to giving you leverage when negotiating with the supplier, this knowledge is quite significant since it sheds light on an aspect of the competitor’s corporate strategy.

Let’s imagine your company works well in the consumer electronics market but needs help to compete in the clothing market. You may either invest in the troublesome sector or concentrate on retaining your competitive edge in the electronics market, depending on your business plan.

Any of the following instances can be adapted to meet your requirements and goals. But, the most important thing to remember is that PI enables you to base your choices on knowledge about the market and your competitors. In other words, it aids in the educated decision-making process for your pricing image.

Here is a quick formula you may use to figure it out for a single product to give you an idea.

Source: Prisync.com

Divide your competitor’s product price by your price and multiply it by a hundred.

Source: Prisync.com

Add up all competitor price indices and divide the result by the total number of competitors. This way you can find out the price index for a single product for numerous competitors.

Price Index can guide your pricing decisions

The Price Index shows how your products, a category of products, or all of the products are positioned in the market. The formula can be used to compute them manually, or also a pricing tool can be used to quickly and easily gather PI data and test different price points.

Consider a scenario when a competitor undercuts you on a certain product but charges more for all the other products you match. They probably negotiated a better price with the supplier. Another theory is that they have fewer overhead expenses. Although if that were the case, the pricing of the other brands would probably reflect that.

Given this knowledge, you will be in a stronger position to negotiate with the provider. Also, you may choose to focus your efforts on a product where you have a competitive edge.

Either way, you’ll be able to make well-informed decisions based on your current data.

You can raise your pricing to a point where you still provide the highest price. While also having higher profit margins in a different case when you’ve seen that you offer a below-average price for a product.

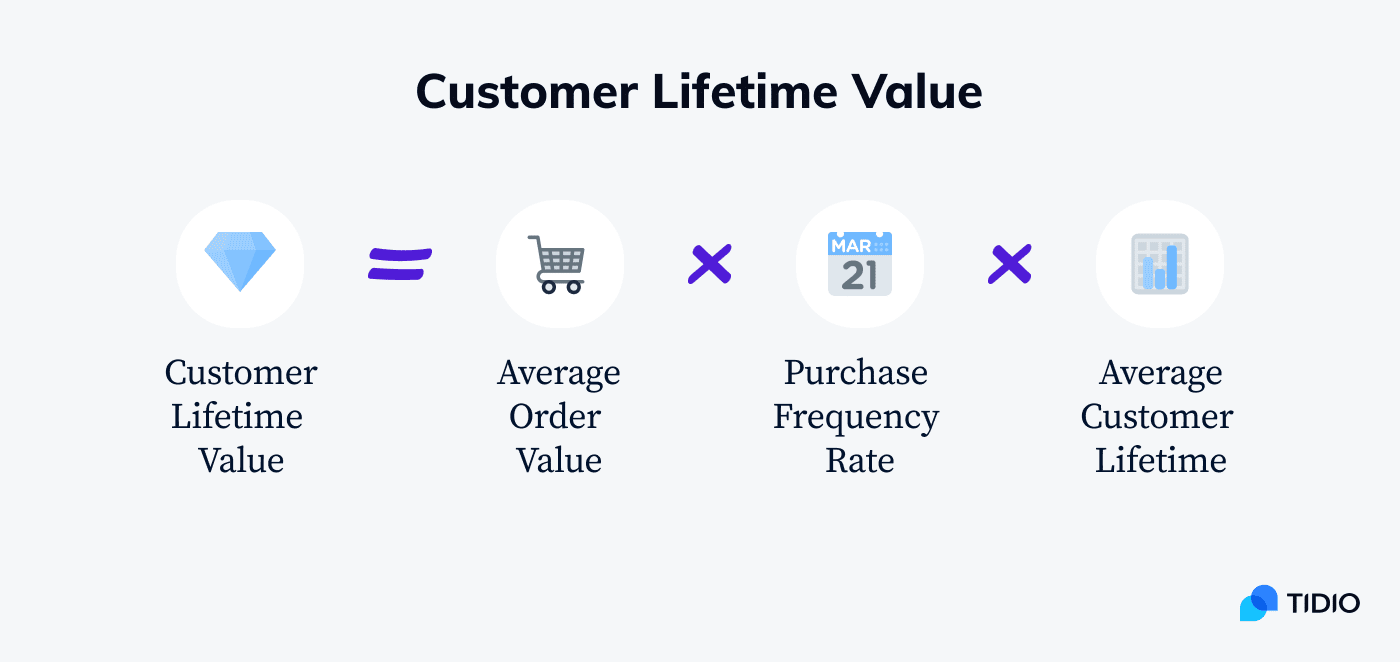

Calculating the Lifetime Value (LTV)

The lifetime value (LTV) of your customers is another quick success you may achieve on your data journey. This makes it easier to identify the ads and media campaigns that attract the most devoted customers. Not all customers provide the same amount of money to your business; instead, their purchase frequency and recentness will determine how much value they add relative to the price you paid to acquire them (customer acquisition cost.)

By creating a completely improved ecommerce experience, you can tighten the gap while also boosting your organization to new heights by gathering information about your buyers’ identities, behaviors, and interests.

Source: tidio.com

Moreover, the lifetime value metric of customers can be used to calculate the retail price. You must add a profit margin to the retail price you set for a product to break even. This profit margin must be equal to your cost of goods plus a markup.

The following simple formula may be used for summing up this pricing strategy:

Retail Price is calculated as [(Item Cost) / (100-Markup Percent)] x 100.

Online retailers must take into account several elements when determining their pricing strategy, including their company’s niche, the competition, market behavior, and most crucially, financial objectives.

All business owners, regardless of size, should experiment and combine strategies to produce the best pricing plan to guarantee the profitability of their organization.

Make use of historical price data

We are aware that monitoring competitor data takes a lot of time and money. But you can get significant information to determine your strategies from it.

You’ll identify patterns in competitor performance after gathering data for a certain period. You’ll learn about their off-season sale schedule. The items they frequently mark down. How much their prices rise following popular sales season, etc.

With this knowledge, you may respond to their pricing methods without suffering a loss.

Additionally, you should also examine your past pricing information. What changed in terms of your competitive strength since the start of the year? Which price points attracted more clients? Which items are more elastic than others? Is your affordable pricing the only reason you’ve improved your competitiveness?

It is very important to find answers to these questions and to examine the data in which the answers lie.

Summing up

As all retailers already know, most customers search for the lowest price. You must thus compete on pricing. You must perform a price study to determine your position in the market before deciding on a pricing plan. It is possible to do this only by mastering your data.

You should define your competitor as a first step. The pricing strategies should then be calculated to determine the short-term competitor strategies. Moreover, to maintain or strengthen your competitiveness, you need to constantly alter pricing in comparison to competitors.

To find out what rivals are planning for the long term and how they will act over time, you must evaluate past & current pricing data if you want to succeed in your business and increase profitability.