According to the U.S. Small Business Administration Office of Advocacy, there were 30.7 million small businesses in the United States as of 2016. This makes up 99.9% of all businesses. While the term “purchase order” may be associated with procurement from larger companies, it is also vital for the day-to-day operations of our economy’s largest contributor.

The entire process of accounts payable can seem like an administrative headache. You trust your vendors to give you correct orders at your agreed price, right? However, there are many benefits of adopting purchase orders into your procurement process. You can do this manually, but it may also be done with accounting software.

This guide will go over the purchase order process so that your business can keep track of your expenses and ensure accuracy in your accounts. By establishing a purchase order system, your company will be on the road to better money management and a more efficient accounting department.

What is a Purchase Order?

A purchase order is, essentially, a binding contract between a customer and a vendor that agrees on the quantity and pricing of a product or service. It is a legal document drafted by a customer to be accepted or rejected by the vendor. This legal document should be a vital part of your purchasing system.

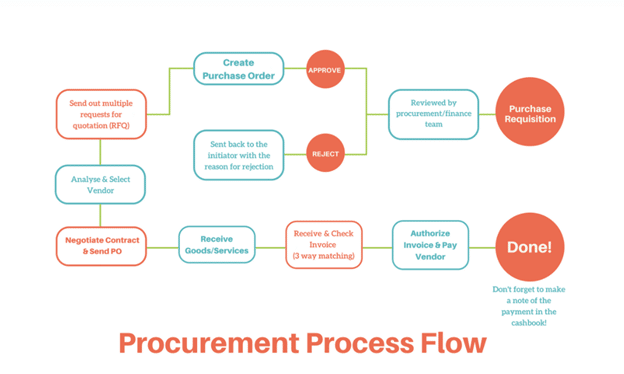

Purchase orders are an essential step in the procurement or purchasing process. A small business can send out requests for quotations from one or more vendors. They can then create a purchase order from that quote. For some businesses, it will be a way to negotiate a contract or price.

If you are employing a specific discount strategy, using quotes and purchase orders can be a good way to cut costs. This way, you will be able to gain sales from different promotions while still making a profit.

https://kissflow.com/procurement-process/#:~:text=What%20is%20a%20Procurement%20Process,purchase%20order%20and%20invoice%20approval.&text=Regardless%20of%20the%20uniqueness%2C%20every,Process%2C%20People%2C%20an

A purchase order represents your intent to buy products or services. You, as the customer, are responsible for creating this document. Communicating with the vendor may also be useful when drafting your purchase order. This is especially true if you are not creating the document from a quote. Consider an enterprise communication solution to keep in contact with your vendors and customers alike.

Purchase order vs. invoice

If you have never used purchase orders before, it may be difficult to discern the difference between these legal documents and invoices. So, what IS the difference between an invoice and a purchase order?

A purchase order is, in practice, a reverse invoice. A customer is responsible for drafting and sending the purchase order and the vendor is responsible for sending the invoice.

The two often work in tandem. The purchase order number or PO number matches the resulting invoice number sent by the vendor. In a procurement process, the PO comes before the invoice. The invoice is a receipt that the vendor has met its obligation set out during the PO process.

Why Use Purchase Orders?

The PO process allows businesses to track inventory and cost while ensuring accuracy. It can also be an important aspect of project management. Purchase orders allow you to track what vendors are providing which products or services to ensure that your project workflow is running smoothly. It also allows purchasing departments to confidently fill out order forms for goods and services.

Purchase orders also make procurement legal and accountable. By creating a paper trail, you are protecting yourself in the event of an audit. Having an audit trail is vital to protecting your business. Keeping these records also allows your business to do your own auditing of your finances.

The matching of invoices and purchase orders gives your purchasing departments and accounts payable team members confidence during the procurement process, and when paying invoices. Supplying a purchase order also shows efficient financial management. It allows your business to track payments and incoming orders, reduce the possibility of duplicate orders, and can assist in budgeting.

Having a purchase order also gives you more control over your retail KPIs, giving you the perfect order rate. You have a contract of when an order is expected to come in. This lets you know exactly when you will be able to then provide or ship that inventory to customers.

Types of Purchase Orders

https://kissflow.com/procurement-process/#:~:text=What%20is%20a%20Procurement%20Process,purchase%20order%20and%20invoice%20approval.&text=Regardless%20of%20the%20uniqueness%2C%20every,Process%2C%20People%2C%20an

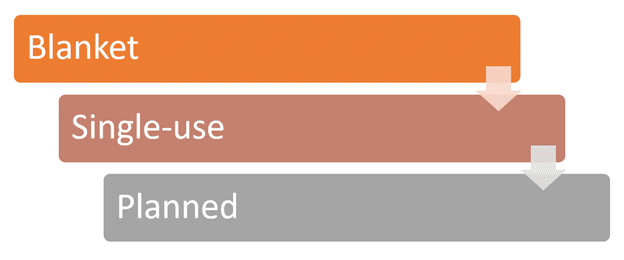

While the basic principle of purchase orders is the same in any situation, there are several different types. They include:

Blanket purchase order

This is used when procurements from a vendor are needed over an extended timeframe. If a vendor is sourcing a product or service over time, it may be helpful to secure a specific price. This type of purchase order requires a customer to commit to a product or service with set terms. It allows for reorders without requiring an additional PO.

Single-use purchase order

Single-use POs are used when ordering something that you may not need again. It can also be used if you always require products and services in different types or quantities.

Planned purchase order

Planned purchase orders are similar to single-use, but instead of being immediate, they roughly predict future needs. If your company needs a product or service and you wish to sort it out now, a planned purchase order may be suitable.

For example, if you are designing a website and need to do the “Development” step in your Magento checklist, it may be useful to find the developer before your need. It ensures, when you reach that step, the rollout of your website isn’t stalled. You will have your PO ready whenever you are.

Process

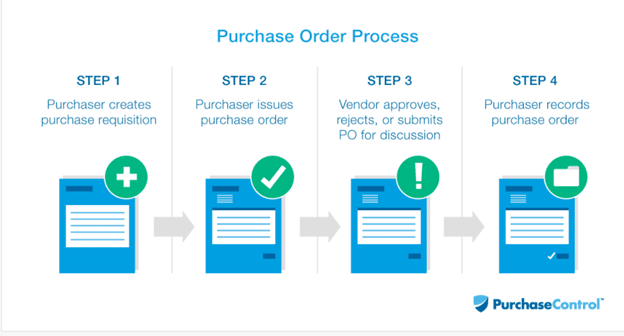

The basic process of a purchase order includes the following steps:

1. Creating a purchase requisition

If you have a small business made up of different departments, your order request may need to be passed by your accounting team or by management before the PO is made. This requires the team member making the order to make a purchase request.

The approval process reduces the risks of mistakes or redundancies when orders are made. It also ensures the products or services requested are within the available budget.

2. Issuing the purchase order

This would generally be done by email or via the vendor’s website. However, for vendors you regularly deal with, it may be useful to find more informal communication channels with your reps. Consider messaging platforms for communicating with vendor representatives. Slack alternatives, like Glip, Chanty, and Google Chat, are great services for quick, reliable communication.

3. Approval, rejection, or negotiation by the vendor

The approval, rejection, or negotiation is initiated by the vendor after they receive your PO. Hopefully, this step is quick because the terms should have been relatively agreed upon before. However, if negotiations are needed or if your PO is rejected, you may have to repeat steps 1 and 2.

4. Record the PO

Make sure the PO is recorded after it has been accepted. After the products or services come in or are performed, and an invoice is delivered, then the accounting department can match the invoice to the PO.

https://www.purchasecontrol.com/blog/purchase-order-process/

Considerations

With everything else you have to think about running a small business, these added responsibilities may seem time-consuming. However, today there are plenty of ways to automate this process. Automation allows for accurate record-keeping while giving you time to focus on other tasks.

Consider getting e-procurement or other procurement software to make the PO process simple and efficient. Using this software also ensures that your inventory and accounts payable are updated in real-time.

In doing so, you reduce the risk of double orders or errors in your inventory management systems. It also allows you to streamline the process allowing for virtually automatic order management. Real-time accounting can instantly update your books, so you can be proactive with your business’s finances.

If you choose this type of digital management, make sure you have other systems in place to facilitate data protection. Your data is one of your most valuable assets and you do not want your accounting and inventory information in the wrong hands.

It may also be helpful to create a vendor directory or database. This allows you to keep track of your vendors and easily access previous orders or procurements. In this directory, you can include contact information, typical payment terms, and the vendor’s invoicing process. This way, your team members can pinpoint any anomalies in the invoices or the purchase orders.

While this seems like a lot of information, with a template, it can be an efficient and easy process. If you have a business that deals with a lot of vendors and customers in a day, it may be difficult for standard representatives to field and transfer all the calls they receive. To facilitate the purchase order process while keeping customer satisfaction high, you may want to consider utilizing an omni channel call center.

By using this kind of call center, you make sure calls are always routed to the right team member. It can foster positive relationships with customers and vendors by making sure they can reach the right department and always receive personalized and efficient communication.

If your vendors like to work with you, they will be more likely to negotiate terms and services in your favor. Read “Call center management: Strategies and best practices of successful call centers” to find out more.

Template

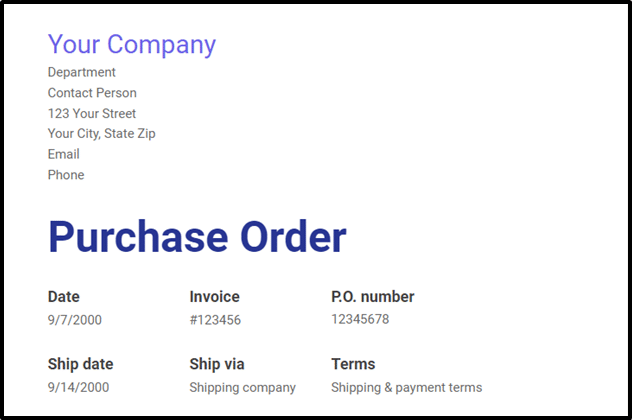

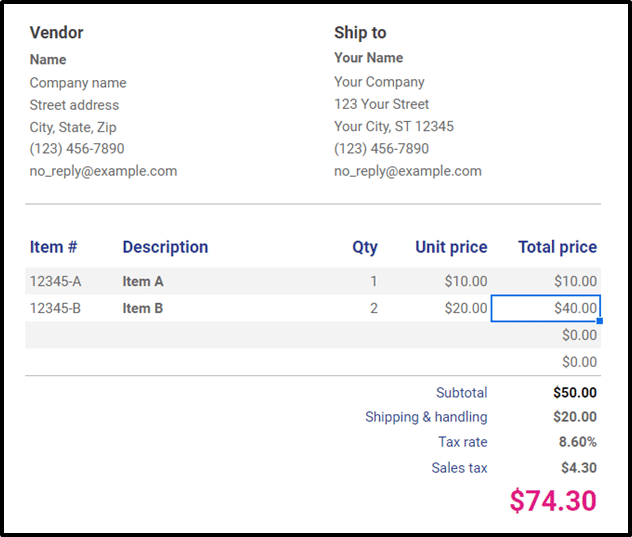

Now that you know the process, it is useful to know what you should include on a standard purchase order. If you use accounting software, it may already include templates for purchase orders. Typically, you can edit these templates to suit your needs. Your purchase orders should include:

PO number

The invoice number should correspond to the PO number or the vendor should include the PO number on their invoice. It may also be helpful to include the invoice number (if available) in your purchase order.

Your business’s (the purchaser’s) details

This should include the department, person of contact, address, and email.

Payment terms

Indicate if you intend to pay upon receipt of the invoice or if the vendor agreed to terms, like Net 30. If you run a retail business, like an omnichannel ecommerce brand, it may be useful to get extended terms. This allows you a chance to have a positive cash flow. You may also want to indicate if you intend to pay by credit card or check.

Shipping method

This is usually dictated by the vendor unless your business requires special accommodations.

Shipping date or expected delivery date

Make sure your vendor knows when you need the order by.

Vendor details

If you need to send the PO to a particular department, include this as well.

Shipping details

Where do you want the order to be sent?

Item number (if applicable)

This would typically only include products, however, some service vendors use item numbers.

Description

What do you expect the items to look like or what services do you need?

Quantity

How much of each item or service do you want?

Price per unit

This should be before taxes. Indicate the agreed-upon price.

Final costs

This includes:

- Total (before taxes)

- Total tax

- Total net

All this information should be available to you on the vendor website, quote, order form, or from communications with the vendor. Make sure your purchasing department has all the information they need to make an accurate PO. With information and a template, or with an automated system, you can send purchase orders and process invoices with efficiency and accuracy.

Takeaways

Purchase orders are an important part of any business. They allow you to make binding contracts via legal documents with vendors. This allows you to ensure accuracy in your ordering systems and make sure you keep your business processes on-time and under-budget. Integrating purchase orders in your procurement process and accounts payable, can give your team members confidence in buying products and services.

While it may seem time-consuming, you can automate the purchase order process with accounting or procurement software. This will give you time to spend on the receivables side of your business, like time to boost conversions and sales.

Remember, a purchase order is not an invoice or receipt. Always make sure your company has some form of acknowledgment from the vendor that they have fulfilled your order. Once the order comes in, the purchase order can be linked to the invoice and the payment can be made by your accounts payable department.

Hopefully, this guide will help you reap the benefits of integrating purchase orders into your procurement process. It will help protect you in the event of an audit, and allow you to keep your company within budget and financially responsible.