In this article, we’ll be diving into October’s retail data to identify the key themes that emerged last month. Here are the top level highlights:

- Both the UK and the US online retail markets perform well in October, rising year-on-year by 12% and 24% respectively, in terms of gross merchandise value (GMV)

- Total number of orders placed rises by 6% in the UK and 7% in the US compared to October 2016

- Health & Beauty is the top performing vertical in both the UK and US

Now, let’s explore each of these points in more detail…

Online Retailers Benefit from Increased Online Penetration

There is good news for online retailers this month. According to Brightpearl data, the amount spent by consumers online rose by 12% in the UK compared to October 2016 on a like-for-like basis, which represents a strong performance in light of broader economic indicators. Meanwhile, the performance in the US market for online retailers was considerably stronger than in the UK, with 24% growth on a like-for-like basis.

Overall the news was good for all retailers in the US according to the United States Census Bureau. Initial estimates indicate a 4.6% annual increase in October 2017 compared to October 2016, with the non-store category (which includes ecommerce, as well as catalog sales) posting annual growth of 6.8%.

The results are reflective of the continued shift in wallet spend from physical stores to online retail. As the report from BRC-KPMG on the UK market explains: “Online penetration rate increased from 22.6% in October 2016 to 23.7% in October 2017, the highest penetration rate since December 2016,” which means that online retailers can continue to benefit from this upward trend.

This should translate into further rises in the total number of orders throughout the rest of 2017, which has climbed by 6% year-on-year in the UK and by 7% in the US.

Mixed Results by Vertical

Paul Martin, Head of Retail at KPMG, notes: “Clothing sales were particularly hard hit. After a brief uptick, fashion sales reverted back to the dreary theme we have seen for a number of months this year. Unseasonably warm weather last month will not have helped, but this is unlikely to be the only reason the new ranges are proving unpopular,” as fashion retailers are also battling with increased costs. He goes on to say: “Health and beauty products continued to stand out as a strong performer.”

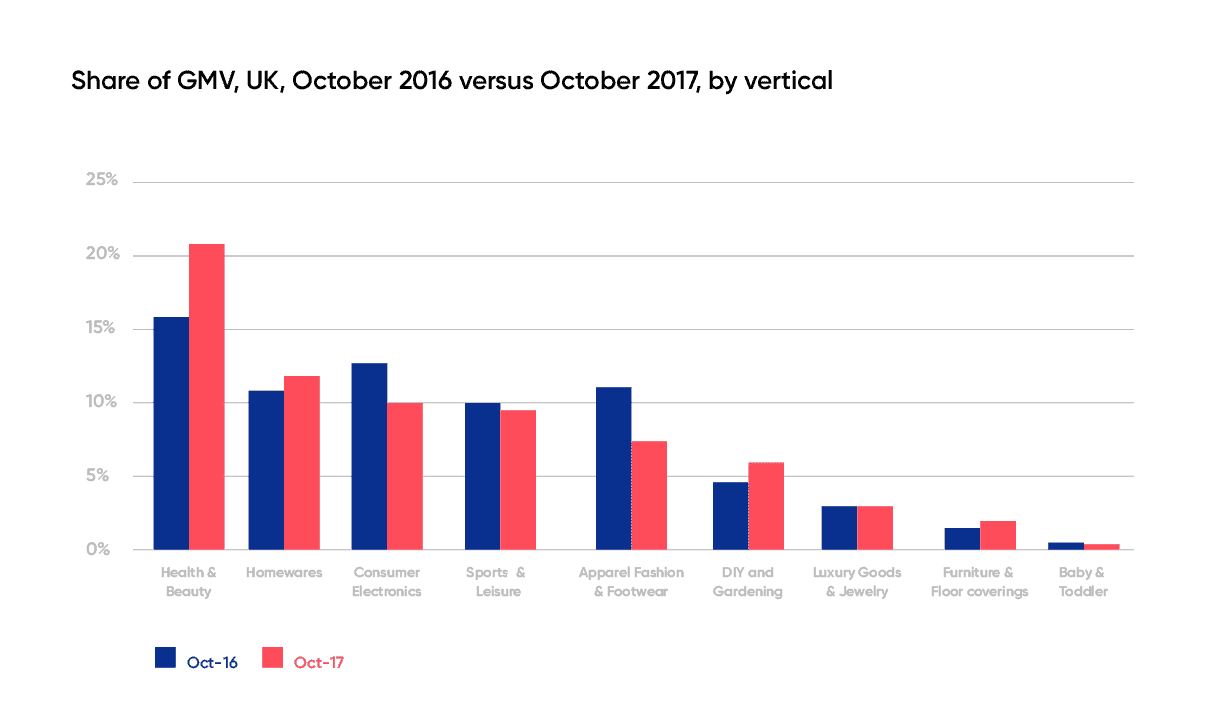

We decided to explore how these observations translate into the performance by vertical within the Brightpearl data by reviewing the change in share of GMV in October 2016 compared to October 2017.

Health & Beauty is Rising Star

Indeed, we can see that the Health & Beauty sector has performed especially well with the largest increase in overall share compared to October 2016, as it increases its share by 4.6% overall. Health & Beauty was also the top performing segment in the US market.

Digital Commerce 360 points out some key reasons why this sector is especially buoyant, as it explains: “The margins on health and beauty items are some of the highest in retail, and return rates, at 1%-2% on average, are some of the lowest. Plus, online health and beauty buyers tend to reorder often on the products they like – so with a really good product or a great loyalty program, a merchant can hook a customer into coming back to buy again and again.”

These macro factors illustrate why the results in both the UK and US are similar in this vertical.

Weather Changes Buying Behavior

We can also see the impact of the warmer than usual October temperatures on the Apparel, Fashion and Footwear segment in the UK. This was the worst performing segment in the Brightpearl data, as its share of GMV dropped by 3.8%, from 11.2% in October 2016 to 7.4% in October 2017. However, this may pick up as the temperature begins to drop in November and the new ranges become more attractive.

One vertical’s loss is another’s gain as the warmer temperatures drove more outdoor activity, a factor that could be seen in the change in share of the DIY and Gardening vertical, which grew its share of GMV from 4.5% in October 2016 to 5.6% in October 2017.

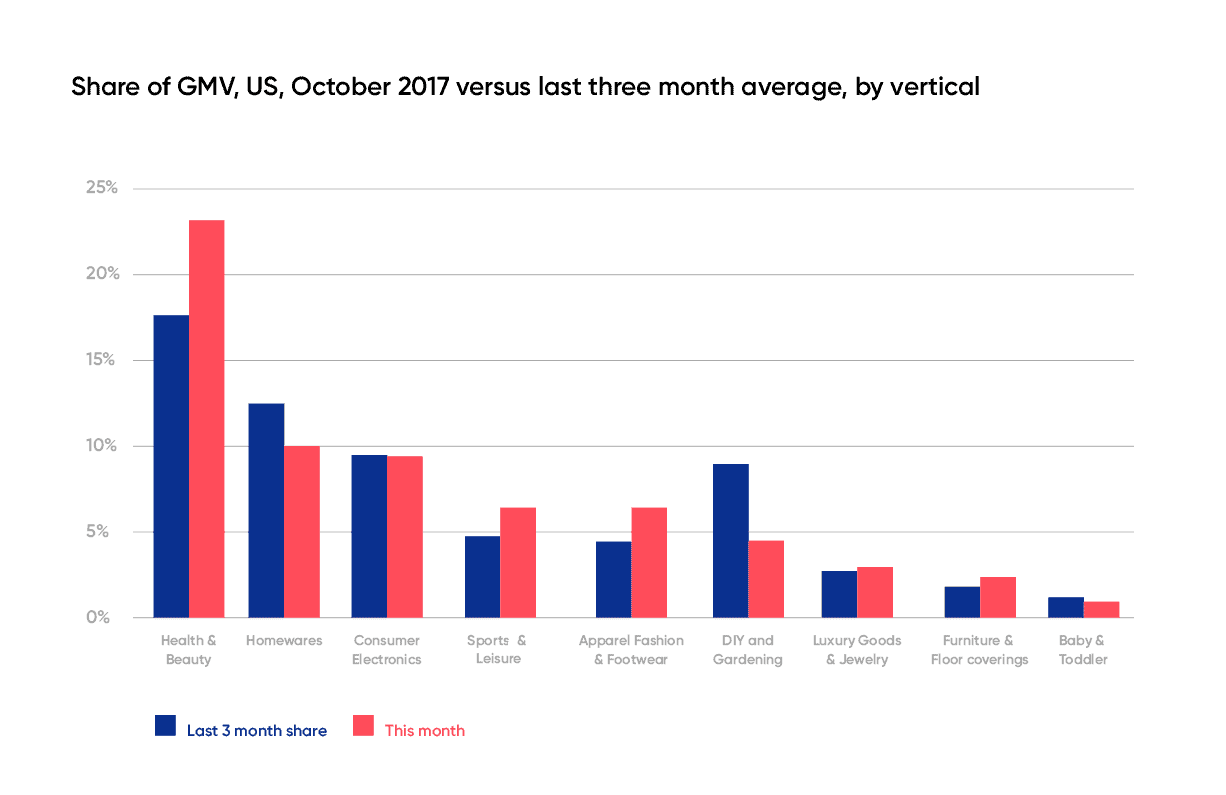

In the US market, aside from Health & Beauty (which saw its share increase by 5.4% compared to the last three month average), Sports, Fashion, Luxury Goods and Furniture also all saw marginal increases in share of GMV; meanwhile Gardening & DIY, Consumer Electronics and Homewares were among the segments to lose ground compared to the last three month averages.

Prognosis for Full Year 2017

As Paul Martin confirms: “The burning question for retailers will be whether shoppers are holding off their purchases until Black Friday,” so we will be reviewing November’s data with interest to measure how this impacts online retail on both sides of the pond.

All retailers will have to prepare strategies for ensuring that consumers continue to spend as we reach the critical months of the year that will dictate how 2017 ends up performing overall.

In particular, Consumer Electronics and Fashion in the UK and Consumer Electronics in the US will be aiming for strong November and December performances in order to end the year on a high; meanwhile Health & Beauty is already well on course for a strong 2017 performance in both markets.

Are you interested in more industry insights like this? Subscribe to the blog now to be the first to know when we publish new reports.