Retail is all about finding the perfect balance between inventory levels and sales. In order to increase sales—and therefore profits—while managing your warehousing and inventory capacity, it’s absolutely vital to get your stock orders just right. Inventory turnover is an essential inventory management metric that helps you do just that.

From increased profitability to optimized efficiency, a rigorous understanding of your inventory turnover is key to a streamlined inventory management operation, allowing you to make better decisions for your business. To do that, you’ll need to calculate your inventory turnover ratio.

In this article, we’ll be walking you through everything you need to know about inventory turnover, including the full inventory turnover definition and the meaning of inventory turnover ratio. So, without further ado, let’s explore the concept and the benefits of better understanding it .

What is inventory turnover?

Inventory turnover goes by a few names: inventory turn, stock turnover, or simply ‘stock turn’. Whichever name you use, the fact is that inventory turnover is a central inventory-management benchmark for omnichannel retailers.

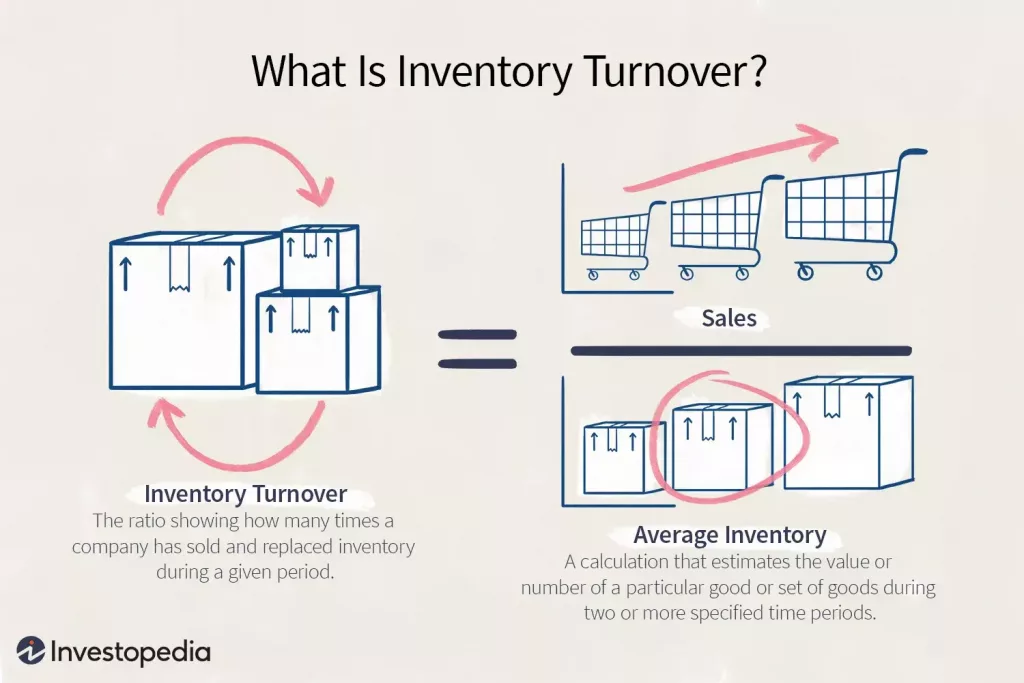

Inventory turnover is the measurement of the number of times a business’s inventory is sold throughout a month, a quarter, or (most commonly) a year of trading. In other words, inventory turnover measures how fast a company sells.

In most typical cases, slow turnover ratios indicate weak sales (and possible excess inventory), while faster turnover ratios indicate strong sales (and a possible inventory shortage).

In essence, inventory turnover is your average yearly inventory. It shows how many times your business has sold (and replaced) inventory during a given period of time. This figure is important because it allows businesses to frame their financial footsteps.

For example, by dividing your average monthly, quarterly, or yearly inventory balance by the number of days in that time period, you’ll be able to calculate how long it will take to see your inventory. That means you’ll be able to make better business decisions when it comes to purchasing quantities, manufacturing choices, pricing, and even your marketing methods.

Why is inventory turnover important?

Why is it so important we understand our inventory turnover? For retailers, especially those with multiple retail channels, optimizing inventory volumes in accordance with consumer demand is absolutely imperative, both in terms of profitability and operational efficiency. And your inventory turnover ratio is a key indicator of just this. Understanding this central metric is the key to optimizing your resources once and for all.

No retailer wants to waste money and resources on unnecessary storage costs. Likewise, no retailer wants to underestimate consumer demand. So, instead of leaving order volumes down to pure guesswork, retailers can seek to optimize their inventory turnover rates.

The benefits are many. Understanding inventory turnover ratios will help you increase profitability and make better business decisions in the long term.

Increase profitability

Understanding your inventory turnover is a one-way ticket to increased profitability. This key performance indicator (KPI) is one of the single most important retail growth indicators as increasing your inventory turnover drives profit. Businesses with high inventory turnover enjoy reduced holding costs and can respond with far greater agility to evolving customer demands. It’s win-win.

Make better decisions

Understanding your company’s inventory turnover will also help you make better, smarter business decisions all around. Why? You’ll know exactly what items need to be ordered or reordered. You’ll understand which units are underperforming, and so be able to come up with strategies to solve that—for example, by reviewing their price, discounting them and so on. And lastly, you’ll be able to anticipate order-demand with greater accuracy, enabling you to attend to manufacturing and production decisions ahead of time.

If the thought of endless calculations is already giving you a headache, you can relax. Mobilizing inventory turnover as part of your everyday retail management practices doesn’t have to be mind-boggling. With the right retail operating system under your belt, you’ll be able to manage your inventory without any of the stress of number crunching on Excel or—worse—on paper.

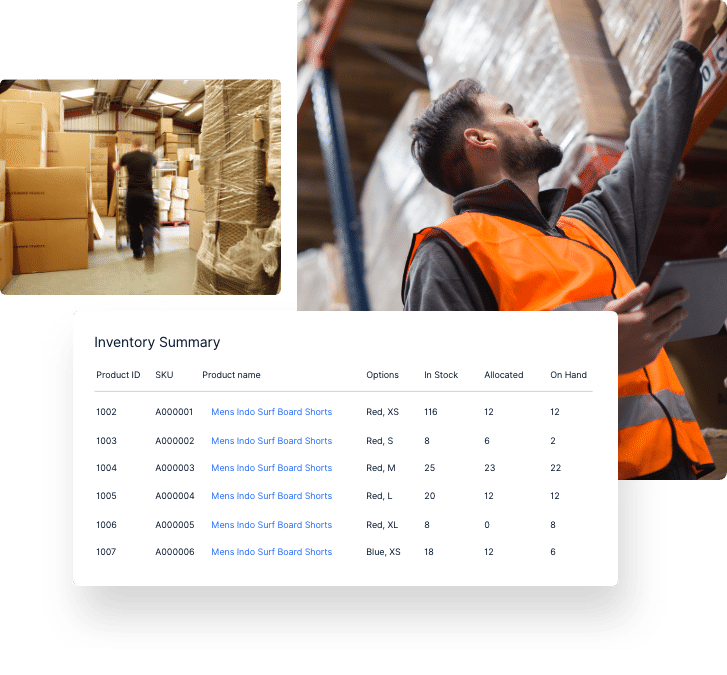

For example, retailers using Brightpearl’s automated multi-location inventory tracking can rest assured that they always have enough inventory on hand and in the right locations to meet customer demand as and when it occurs.

Brightpearl users can access a centralized, 360-degree view of their entire operation, including financial statements, income statements, and—of course—inventory turnover. By managing inventory, orders, warehouses, accounting, fulfillment, shipping, and purchasing this way, retailers are all set to avoid those problematic manual errors or disjointed systems.

Inventory turnover: calculations and examples

We’ve discussed the “what” and “why,” and now it’s time to talk about the “how.” How can retailers calculate their inventory turnover? Whether you’re using a designated inventory management tool or totting up those numbers the old-fashioned way, here’s how to calculate inventory turnover with two different formulas:

Inventory turnover formula A: cost of goods sold

First, determine the total cost of goods sold (COGS) from your annual income statement. Next, calculate the average inventory value by adding together your beginning inventory and ending inventory balances for a single month and dividing by two.

Inventory turnover = cost of goods sold (COGS) / average value of inventory

So, if your COGS is $90,000, and the average inventory value is $15,000, your inventory turnover is six.

Inventory turnover calculation B: sales

Inventory turnover = total sales/average inventory

Work out your average inventory value using the same method as above. Then divide your total sales by this figure.

So, if your total sales are $40,000, and the average inventory value is $10,000, your turnover would be four. Compare this to the average inventory turnover in your industry.

What is a good inventory turnover ratio?

Learning how to interpret inventory turnover is a skill in itself. You’re probably asking, “What’s a good inventory turnover ratio?”. Well, no two companies or situations are ever the same. The optimum inventory turnover ratio for retailers lies between two and six.

If your inventory turnover ratio lies in this zone, it demonstrates that your restock rates and sales rates are in balance. You’ll have just the right amount of inventory to meet demand. You won’t have too much or too little. In the words of Goldilocks herself—just right.

What is a bad inventory turnover ratio?

An inventory turnover ratio any lower than two could indicate that sales are weak and product demand is waning. This could result in excess inventory on the warehouse shelves and wasted space and resources.

On the other hand, an inventory turnover ratio any higher than six is an indication that the consumer exceeds supply. That means your inventory purchase levels might actually be too low, leading to lost sales opportunities as a result—or negative customer experiences from delayed deliveries.

Things to keep in mind when navigating inventory turnovers

It’s time for some inventory turnover best-practices. Before you start to use inventory turnover ratios as part of your retail inventory management process, there are a few things to keep in mind. Let’s take a look:

Inventory turnover and open-to-buy systems

Consider whether your business is using an ‘open-to-buy system as part of your inventory management procedures. Open-to-buy systems are software budgeting systems for purchasing merchandise. These systems are designed to make inventory management and replenishment more efficient by helping retailers monitor merchandise, inventory control, and financing.

For example, Brightpearl’s Inventory Planner allows retailers to create open-to-buy plans in retail, cost, and units. By planning your inventory costs with Brightpearl, you’ll be able to generate a highly accurate budget for each of the three aforementioned categories. Planning your inventory in units like this means you’ll be able to estimate more accurately whether or not you have the capacity in your warehouse.

Inventory turnover and dead stock

Dead-stock—or obsolete stock—is a nightmare for any retailer. Whether goods are perishable, seasonal, or highly vulnerable to changing trends, excess stock can easily become a burden to your cash flow, if not carefully handled. An overabundance of low-demand (or no-demand) goods means money down the drain. It’s super-important to calculate your inventory turnover ratio in order to avoid this situation developing. With a well-balanced supply-and-demand chain, your business should be able to stay in the clear.

Using inventory management software with smart inventory and demand planning capabilities is a great way to reduce the risk of ending up with dead stock that you can’t shift. Brightpearl will use your historical performance data to put your money into the most profitable products and replenish the right inventory, in the right quantities, at the right time.

Challenges when using inventory turnover

As useful a tool as it is, there are some challenges that come with using inventory turnover. Sometimes, retailers get their calculations wrong. Other times, a problem with your inventory management could negatively impact your inventory turnover ratio.

Challenge # 1: comparison

The first challenge associated with inventory turnover is comparison. What exactly meant by this?

It’s important to remember that any time you want to compare your inventory turnover with that of another business, it must be on a level playing field. In other words, there’s no use comparing your retail operation with a business that sells completely different products. Inventory turnover ratios are relative. For example, high-price items like cars can, by nature, be slower to leave the warehouse whereas fashion items and perishable goods move off the shelves much faster.

Challenge # 2: management

The way you manage your warehouse can have a direct effect on your inventory turnover. Even if demand is high, if your warehouse is inefficient and struggling to move goods off the shelves quickly enough, your inventory turnover ratio is going to suffer as a result.

Brightpearl as a Retail Operating System helps you manage every aspect of your warehouse and back-office operations for maximum efficiency.

Challenge # 3: seasonality

For some items, demand is led by the seasons. In other words, demand is not going to be steady all year round. Depending on the product, the high-demand season might be in winter, fall, summer, or spring. For example, if you’re a retailer specializing in Christmas trees, then yup, you guessed it, your sales are going to spike in December. Your inventory turnover ratio will undoubtedly be impacted by seasonal demand. As such, it is essential to track and fully understand your seasonal demand patterns.

Challenge # 4: high-cost items

As mentioned above, higher-cost items tend to move off the shelves more slowly. Customers tend to do their research and take their time before investing in big-ticket items like cars and electronics. As such, a lower inventory turnover is likely. You need to do your research and be sure that these items are worth the potential wait on the warehouse shelf. After all, nobody wants an expensive product when it’s obsolete.

Challenge # 5: over-ordering

Excess inventory (overstocking) is the enemy of profit and efficiency. If you bulk-buy too many items, your inventory turnover ratio is going to suffer. With all the capital tied up in bulk inventory, it could take a very long time to get that money back. In general, it’s better for retailers to reduce their carrying costs by resisting the urge to buy in bulk, even where there are economies of scale or discounts to be had. If those products aren’t going to shift, those potential savings from the manufacturer could be meaningless.

Challenge # 6: inaccurate data

If you’re not tracking your inventory accurately then your inventory turnover ratio isn’t going to be accurate, either. Having precise inventory data at your fingertips is absolutely essential. And the best—and easiest—way to achieve this is by using an inventory management system to track and analyze all of your inventory-related data in a single place.

Brightpearl’s retail operations platform helps retailers stay on top of their data. You’ll be able to manage multichannel and multi-location retail operations with ease. Whether you have multiple inventory locations or inventory across different sales channels, Brightpearl will automatically update your inventory levels in real-time so you can know exactly what inventory you have, how much of it is ready for sale, and the exact location of each product.

Determining the right inventory turnover ratio for your business

We’ve already touched on the ideal inventory turnover ratio, and how this should normally fall between two and six.

And for most industries, an inventory turnover ratio between four and six is even closer, indicating that you’re replenishing your stock on average about once every two months.

However, there really is no one-size-fits-all ratio, and your ideal inventory turnover ratio will depend on several factors, including the industry you work in, the nature of the products you sell, and the markets you serve.

Low-margin industries dealing in fast-moving goods like groceries tend to need to move their inventory as quickly as possible for maximum efficiency. Industries with high holding costs (e.g. vehicles and large electronics) will also prioritize a high turnover in order to minimize costs and generate as much profit as possible. However, and here’s where it gets a bit different, luxury industries (e.g. designer jewelry) tend to have a very low inventory turnover. In this case, however, it’s not necessarily a bad thing. Instead of generating profit via fast turnovers, these kinds of big-ticket items intrinsically have a very high profit margin.

Frequently-asked questions

How do you convert inventory turnover to days?

You can calculate the average number of days in inventory using the days inventory outstanding formula: Days inventory = (cost of average inventory/cost of goods sold) x 365

What is the optimal inventory level?

There is no one-size-fits-all optimal inventory level. Your ideal inventory level will depend entirely on your industry and the nature of the products you’re selling as a retailer. In general, low-cost/ high-turnover products have higher inventory turnovers than high-cost/ low turnover items like luxury goods. That’s because high-ticket items have a much higher profit margin.

What is the average inventory turnover period?

The average inventory turnover period is one year. Some companies will choose to measure their inventory turnover over a period of a month or business trading quarter.

How do I find inventory turnover ratio from a balance sheet?

Your balance sheet will tell you the COGS, the value of your beginning and ending inventory, and your annual sales figures. These are the numbers you need to perform the calculations we described earlier.

What does a low inventory turnover ratio mean?

Low inventory turnover means you’re not selling your products quickly enough. They’re tying up cash, incurring holding costs, and at risk of deterioration. A low ratio can be caused by overstocking or inefficient sales.

What can cause a decrease in inventory turnover?

Turnover might decrease due to a downturn in sales, potentially caused by negative publicity, the death of a trend, or an economic crisis. If you don’t pay attention to product performance, you might fail to drop slow-moving items from your catalog.

Why would inventory turnover increase?

Increased turnover is often due to high demand for a particular item, thanks to a strong marketing campaign, a promotion, or a celebrity using your product. Or maybe you’ve moved to a Just-In-Time method, holding just enough stock to meet demand.

Can inventory turnover be too high?

Very high turnover might actually be a bad thing—it can mean you’ve got too little stock, which will be a problem if there’s a sudden spike in demand. Keep an eye on escalating turnover rates and look for underlying issues.

What is the average inventory turnover ratio by industry?

The average inventory turnover for the retail industry is around 10.86, although this varies widely between different types of retail. For grocery stores it’s more like 14, while car dealerships are as low as three. The financial industry has an incredibly high ratio of around 48, as these firms don’t hold much physical inventory.

Low-margin industries tend to have higher ratios than high-margin industries, so always compare yourself to brands within your vertical.

Get calculating

So, there we have it. A full awareness of your inventory turnover ratio is essential for any multichannel retailer, as is an understanding of where that ratio fits into the nuances of the industry and market you are operating in.

Understanding and staying on top of your inventory turnover is vital to ensuring your inventory levels are consistently optimized, allowing you to make better and more informed decisions on pricing, seasonality, marketing, manufacturing, and the purchasing of new stock.

Luckily, tools exist to take care of this, and mastering your inventory management tasks is now easier than ever thanks to automated retail operations platforms like Brightpearl. You’ll be able to track all of your key performance metrics, including your inventory turnover alongside sales, shipping, warehousing, POS, and more.